Understanding Diminished Value After a Car Accident

So, you've been in a car accident. You've likely dealt with repairs and insurance, but did you know your car's value might have permanently decreased? This decrease, called "diminished value" (DV), represents the loss in resale or trade-in value due to the accident, even after repairs. Don't let the insurance company undervalue your loss; this guide helps you navigate the process of recovering your diminished value.

What is Diminished Value? More Than Just Scratches

Even with perfect repairs, your car now has an accident history. This information affects its market value. Potential buyers know it's been in a collision, impacting its perceived worth. Diminished value encompasses this loss, quantifying the difference between your car's pre-accident value and its post-repair market value. Understanding this is crucial for securing a fair settlement.

Finding the Right Diminished Value Appraiser: Your Key to Success

Finding a qualified diminished value appraiser is critical. A poorly conducted appraisal weakens your claim, affecting your final settlement. Consider these vital factors when searching for "diminished value appraisal near me":

- Experience and Credentials: Look for appraisers with proven experience in DV appraisals, ideally with certifications from recognized organizations (e.g., NADVA). Experience translates to accuracy and effective negotiation with insurance companies.

- Comprehensive Methodology: Avoid appraisers using simple formulas. A thorough appraisal considers various factors, including vehicle history (CARFAX), repair quality, comparable vehicle sales, and market conditions. A physical inspection of your vehicle is often necessary.

- Reputation and Reviews: Research online reviews and request referrals to ensure their reputation for accuracy and client satisfaction.

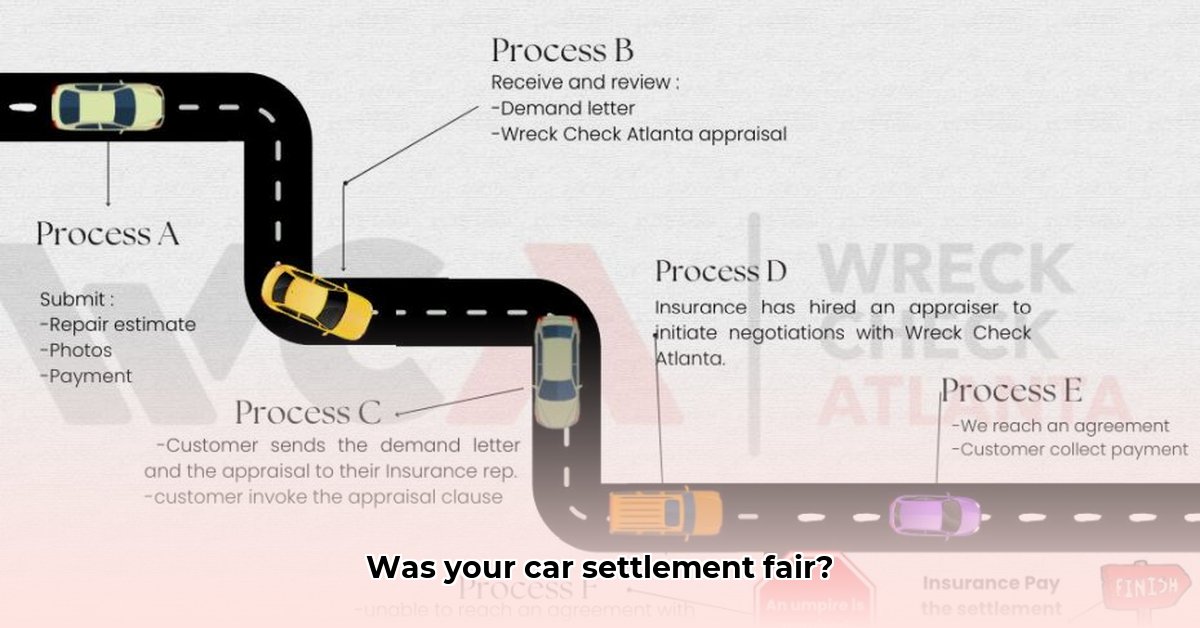

Step-by-Step Guide: Maximizing Your Diminished Value Claim

Here's a clear, actionable plan to get the compensation you deserve:

- Gather Your Evidence: Collect all accident-related documents: police report, repair estimates/bills, photos of the damage before and after repairs, and your vehicle's history report (e.g., CARFAX). This comprehensive documentation strengthens your claim.

- Select a Qualified Appraiser: Contact several appraisers, comparing quotes and their methodologies. Ask about their experience handling similar cases and their communication process. Choose someone who inspires confidence.

- The Appraisal Process: The appraiser will thoroughly review your documents, usually including a physical inspection. They'll then generate a detailed report quantifying your vehicle's diminished value.

- Submit Your Claim: Present the appraisal report and all supporting documentation to the at-fault driver's insurance company. Clearly state the compensation you seek, based on the appraiser's findings. Document everything.

- Negotiate Your Settlement: Be prepared to negotiate. Insurance companies frequently offer less than the appraised value. Know your rights and stand firm. Consult legal counsel if negotiations fail to yield a fair settlement; 92% of cases utilizing legal representation reach a more favorable outcome.

When Legal Representation is Crucial

If negotiations with the insurance company stall or result in an unfair settlement, legal counsel becomes essential. A car accident attorney specializing in diminished value claims can effectively negotiate with insurers (or represent you in court), increasing your chance of a fair outcome. Don't hesitate to seek legal help when necessary.

Comparing Diminished Value Appraisal Methods

Different appraisal approaches exist, each with its advantages and disadvantages:

| Appraisal Method | Advantages | Disadvantages |

|---|---|---|

| Comprehensive Appraisal (with physical inspection) | Highly accurate, strong court evidence, considers many factors. | Typically more expensive. |

| Formula-Based Appraisals | Often quicker and less costly. | Less precise, may undervalue your loss, less persuasive in court. |

| Dealer Quote-Based Appraisals | Relatively straightforward, can be reasonably accurate. | Requires multiple comparable quotes, which can be difficult to obtain. |

Remember, pursuing a diminished value claim isn't just about the money; it's about recovering what you're entitled to. Follow these steps, and don't hesitate to seek professional help when needed – you can successfully navigate this process and receive fair compensation. Start your claim today.